From Reason Foundation, "

As regulators fight big tech mergers, startups often pay the price: Regulators deterred Amazon’s acquisition of iRobot. They may also have deterred innovation and future competition." by

Max Gulker, Senior Policy Analyst:

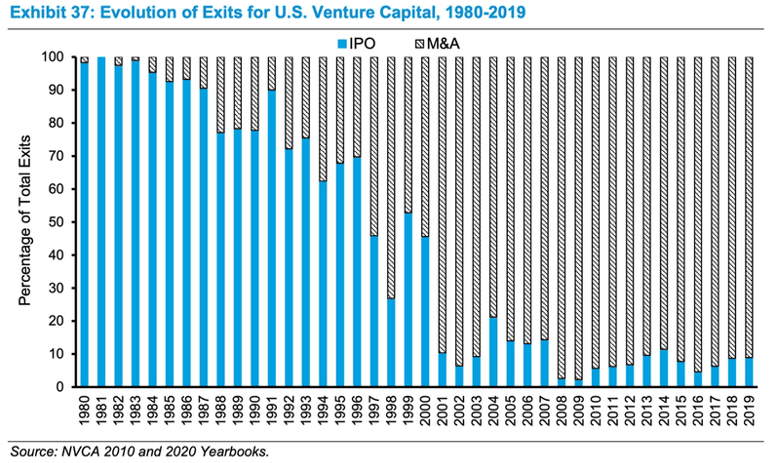

The venture capital model has thereby played a critical role in democratizing entrepreneurship, and merger and acquisition (M&A) transactions are critical to the venture capital model. Around the turn of the 21st century, digital and online startups started outnumbering businesses that provide products and services mostly in the physical world. As the figure below shows, successful exits for venture capital investments in startups went from overwhelmingly IPOs to overwhelmingly M&A.

Many of these ultimate M&A transactions represent a startup with a unique capability of innovating along certain lines. Large companies, who may be able to distribute the technology more efficiently or create incremental improvements, seek to acquire such startups after successful venture capital funding has lessened uncertainty.